The best 26 Finance books

Navigate the intricate world of finance with our carefully curated book list. From personal finance to investment strategies, these titles offer practical insights to help you make informed decisions and gain financial independence.

Whether you're a finance novice or looking to enhance your financial literacy, these books will equip you with the knowledge and tools to navigate the world of money. Start your journey to financial success today with our comprehensive collection.

What's Flash Boys about?

Flash Boys (2014) is an investigation into the dark underbelly of the US financial markets. It also chronicles the birth of a new stock exchange, the IEX, created to counteract a rigged system that was facilitated by technological loopholes and a lack of transparency.

Who should read Flash Boys?

- Anyone who’s ever invested in the stock market

- People interested in stories of financial corruption

- Fans of underdogs who fight the system

What's Reminiscences of a Stock Operator about?

Reminiscences of a Stock Operator (1923) looks at the life and trading strategies of Jesse Livermore, a professional stock and commodities trader, through the pseudonymous character of Larry Livingston. It explores the psychological challenges and strategic complexities of trading, offering timeless insights into market behavior and the discipline required for success in the financial world.

Who should read Reminiscences of a Stock Operator?

- Aspiring traders seeking market wisdom

- Investors interested in trading history

- Business students applying real-world trading

What's The Business Of The 21st Century about?

The Business Of The 21st Century (2010) focuses on the transformative power of network marketing. It advocates for the creation of personal wealth through entrepreneurship, emphasizing the shift from traditional employment to innovative, individual-driven business models. It provides insights into leveraging networking and direct sales as tools for financial success and personal growth.

Who should read The Business Of The 21st Century?

- Aspiring entrepreneurs interested in network marketing opportunities

- Individuals open to non-traditional income streams

- Employees seeking to control their financial future

A Random Walk Down Wall Street

What's A Random Walk Down Wall Street about?

A Random Walk Down Wall Street (1973) looks at the unpredictability of stock market prices, linking their movements to a “random walk.” It dispels the generally accepted belief in discernible market patterns, suggesting that consistent gains are not a product of easily-chartered trends.

Who should read A Random Walk Down Wall Street?

- Aspiring investors

- Stock market analysts

- Economists interested in financial market patterns

Too Big to Fail

What's Too Big to Fail about?

Too Big to Fail (2009) draws you into the heart of the 2008 financial crisis, revealing the high-stakes decisions and power struggles that shaped the world's economic landscape at that time. This gripping narrative untangles a complex web of financial intrigue, and will help you understand the forces that drove one of the most tumultuous periods in financial history.

Who should read Too Big to Fail?

- Finance professionals interested in economic crisis insights

- History buffs exploring twenty-first-century financial events

- Business students studying real-world corporate strategy

What's The Little Book That Beats the Market about?

In this book, Joel Greenblatt shares a simple yet effective investment strategy that aims to outperform the market. He introduces the concept of "magic formula investing" which focuses on buying good companies at bargain prices. Through clear explanations and real-life examples, Greenblatt provides valuable insights for both novice and experienced investors. Whether you're interested in stock market investing or simply want to understand how to make better financial decisions, this book offers practical advice and a unique perspective.

Who should read The Little Book That Beats the Market?

- Individuals looking for a practical guide to investing in the stock market

- Those who want to learn a simple, yet effective strategy for selecting profitable stocks

- Beginner investors who are interested in learning from a successful investor with a proven track record

Economics in One Lesson

What's Economics in One Lesson about?

In this classic book, Henry Hazlitt presents a concise and accessible introduction to the principles of economics. Through clear and practical examples, he demonstrates how economic policies and decisions can have both seen and unseen consequences. Hazlitt argues for a free-market approach and challenges common misconceptions about economic issues, making it a must-read for anyone interested in understanding the fundamentals of economics.

Who should read Economics in One Lesson?

- Individuals seeking a clear and concise understanding of economics

- Readers interested in learning about the unintended consequences of government intervention in the economy

- Those who want to become more informed citizens and make better economic decisions

DotCom Secrets

What's DotCom Secrets about?

DotCom Secrets is a book that reveals the strategies and techniques for building a successful online business. Written by marketing expert Dan Kennedy, the book provides valuable insights into creating sales funnels, driving traffic, and converting leads into customers. It is a must-read for anyone looking to thrive in the digital marketplace.

Who should read DotCom Secrets?

- Entrepreneurs looking to create successful online businesses

- Individuals interested in learning about online marketing and sales strategies

- People who want to understand the principles behind building a strong online presence and generating leads

Buy Then Build

What's Buy Then Build about?

This book provides a comprehensive guide for aspiring entrepreneurs who want to acquire an existing business rather than starting from scratch. It offers practical advice on how to identify, evaluate, and negotiate the purchase of a business, as well as tips for successfully growing and scaling the acquired company. With real-life examples and actionable insights, "Buy Then Build" is a valuable resource for anyone interested in the world of business acquisitions.

Who should read Buy Then Build?

- Entrepreneurs interested in acquiring businesses instead of starting from scratch

- Business owners looking to expand their knowledge on acquisition strategies

- Individuals seeking practical guidance on growing a successful business through strategic purchases

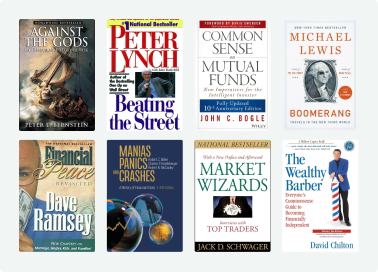

What's Against the Gods about?

Against the Gods by Peter L. Bernstein challenges the age-old belief in fate and providence by delving into the history of risk and probability. From ancient civilizations to modern financial markets, Bernstein explores how humanity has sought to understand and control uncertainty. With engaging storytelling and insightful analysis, the book offers a fresh perspective on our relationship with risk and the power of rational thinking.

Who should read Against the Gods?

- Individuals interested in understanding and managing risk in their personal or professional lives

- Readers who enjoy exploring the history and psychology of financial markets

- Entrepreneurs and business leaders looking to make informed and strategic decisions

What's Market Wizards, Updated about?

Market Wizards, Updated by Jack D. Schwager delves into the world of successful traders and their strategies. Through in-depth interviews and analysis, the book provides valuable insights and lessons for anyone looking to navigate the unpredictable world of financial markets. Whether you're a seasoned investor or a novice, this updated edition offers timeless wisdom and practical advice to help you achieve your trading goals.

Who should read Market Wizards, Updated?

- Aspiring traders looking to learn from the experiences of successful professionals

- Experienced traders seeking to gain new insights and improve their strategies

- Anyone interested in the psychology and mindset required for successful trading

What's Manias, Panics, and Crashes about?

Manias, Panics, and Crashes by Charles P. Kindleberger explores the history of financial crises and their underlying causes. Drawing on extensive research, the book provides insights into the patterns and behaviors that lead to market instability. It offers valuable lessons for investors, policymakers, and anyone interested in understanding the dynamics of financial markets.

Who should read Manias, Panics, and Crashes?

- Investors and traders looking to understand the history and psychology behind market crashes

- Financial professionals seeking insights into speculative bubbles and their aftermath

- Economists and students studying the impact of irrational behavior on financial markets

What's Common Sense on Mutual Funds about?

Common Sense on Mutual Funds by John C. Bogle provides valuable insights into the world of mutual funds and offers practical advice for investors. Through this book, Bogle challenges the prevailing investment practices and introduces his concept of low-cost index fund investing. It presents a compelling case for passive investing and empowers readers to make informed decisions about their investments.

Who should read Common Sense on Mutual Funds?

- Individuals who want to understand the basics of mutual fund investing

- Beginner and intermediate investors looking for practical advice and insights

- Those who prefer a conservative, long-term approach to wealth building

What's Boomerang about?

Boomerang (2011) by Michael Lewis takes a closer look at the global financial crisis and its aftermath. Through a series of captivating essays, Lewis investigates how different countries, including Iceland, Greece, and Ireland, contributed to the economic meltdown and reveals the surprising and often absurd consequences that followed. With his trademark wit and insight, Lewis uncovers the underlying issues that continue to shape the world's economy.

Who should read Boomerang?

- Individuals interested in understanding the global financial crisis and its aftermath

- Readers who enjoy insightful and entertaining non-fiction narratives

- Those looking for a thought-provoking exploration of human behavior and the consequences of economic decisions

What's The Only Investment Guide You'll Ever Need about?

The Only Investment Guide You'll Ever Need (1978) by Andrew Tobias offers practical advice on how to make smart investment decisions. Written in an engaging and easy-to-understand style, the book covers a wide range of topics including stocks, bonds, real estate, and retirement planning. It aims to empower readers to take control of their finances and build a secure financial future.

Who should read The Only Investment Guide You'll Ever Need?

- Individuals who want to learn how to manage their money effectively

- People who are eager to understand the basics of investing and building wealth

- Readers who prefer a practical and straightforward approach to finance

What's Beating the Street about?

Beating the Street by Peter Lynch and John Rothchild is a comprehensive guide to successful stock market investing. Drawing from his own experiences as a renowned fund manager, Lynch shares valuable insights and practical advice on how to identify lucrative investment opportunities, analyze financial statements, and navigate the complexities of the market. Whether you're a novice or seasoned investor, this book offers valuable strategies for beating the odds and achieving financial success.

Who should read Beating the Street?

- Individuals who want to learn how to successfully invest in the stock market

- Beginner and intermediate investors looking for practical advice and strategies

- People who are interested in understanding how to analyze and pick stocks

What's The Wealthy Barber about?

The Wealthy Barber by David Chilton is a personal finance book that offers practical advice on how to build wealth and secure your financial future. Through a fictional story about a barber who shares his financial wisdom with his clients, Chilton presents key principles such as saving, investing, and planning for retirement in an easy-to-understand and relatable way.

Who should read The Wealthy Barber?

- Individuals who want to improve their financial literacy

- People who are looking for practical advice on saving and investing

- Anyone interested in building long-term wealth and financial security

What's Extraordinary Popular Delusions and the Madness of Crowds about?

Extraordinary Popular Delusions and the Madness of Crowds by Charles MacKay delves into the world of irrational behavior and mass hysteria. With a focus on historical events such as financial bubbles, witch hunts, and superstitions, the book explores how the human mind can be susceptible to folly and deception, shedding light on the collective madness that has shaped societies throughout history.

Who should read Extraordinary Popular Delusions and the Madness of Crowds?

- Curious individuals seeking to understand the psychology behind mass hysteria and delusions

- Investors looking to recognize and avoid financial bubbles and speculative manias

- History enthusiasts interested in exploring past examples of groupthink and irrational behavior

What's Financial Peace Revisited about?

Financial Peace Revisited, by Dave Ramsey and Sharon Ramsey, is a comprehensive guide to achieving financial stability and freedom. It offers practical advice on budgeting, saving, and investing, as well as tips for getting out of debt. Through real-life examples and relatable anecdotes, the book provides a step-by-step plan for taking control of your finances and building a secure future.

Who should read Financial Peace Revisited?

- Individuals who want to take control of their finances and achieve financial freedom

- People who are struggling with debt and want to learn how to get out of it

- Those who are looking for practical and actionable advice on budgeting, saving, and investing

What's Irrational Exuberance about?

Irrational Exuberance by Robert J. Shiller examines the recurring patterns of speculative bubbles in financial markets. Drawing on historical examples and extensive research, Shiller demonstrates how irrational behavior and herd mentality drive asset prices to unsustainable levels, leading to inevitable crashes. He also offers insight into the psychological and economic factors that contribute to these bubbles, providing a fascinating analysis of market dynamics.

Who should read Irrational Exuberance?

- Investors who want to understand the psychology behind market bubbles and crashes

- Financial professionals seeking insights into market valuation and irrational exuberance

- Readers interested in the intersection of behavioral economics and finance

What's Stress Test about?

Stress Test is a memoir by Timothy F. Geithner that provides an insider's account of the financial crisis of 2008. Geithner, who served as the President of the Federal Reserve Bank of New York and later as the Secretary of the Treasury, shares his experiences and decisions during this tumultuous time, offering insights into the challenges faced and the actions taken to stabilize the global economy.

Who should read Stress Test?

- Anyone interested in understanding the 2008 financial crisis and its aftermath

- Individuals working in finance, economics, or government

- Readers looking for insights into decision-making during high-stakes situations

What's Confessions of an Economic Hitman about?

Confessions of an Economic Hitman is a gripping memoir by John Perkins, in which he reveals his experiences as a highly paid consultant who helped orchestrate the economic colonization of developing countries. Perkins exposes the dark side of global capitalism and the role of organizations like the World Bank and the IMF in exploiting and manipulating nations for the benefit of a few powerful individuals and corporations. This eye-opening book sheds light on the hidden mechanisms of economic control and offers a thought-provoking critique of the modern world.

Who should read Confessions of an Economic Hitman?

- Curious individuals seeking insights into the global economy and how it impacts developing nations

- Readers interested in understanding the role of corporations and governments in shaping economic policies

- Those looking for thought-provoking narratives that explore the ethical implications of power and manipulation

What's Law of Success about?

This book delves into the principles of success and the mindset needed to achieve it. Napoleon Hill shares valuable insights and practical advice on how to set and achieve goals, develop a positive attitude, and overcome obstacles. Drawing from interviews with successful individuals, the book offers a comprehensive guide to unlocking your full potential and achieving success in all areas of life.

Who should read Law of Success?

- Individuals who aspire to achieve success in their personal and professional lives

- People who are interested in learning the principles and strategies behind success

- Those who are looking for practical guidance and motivation to overcome challenges and reach their goals

What's The Quants about?

The Quants by Scott Patterson delves into the world of quantitative finance and the rise of mathematical geniuses on Wall Street. It explores how these "quants" used complex algorithms and computer models to make huge profits, but also contributed to the financial crisis of 2008. The book offers a fascinating insight into the high-stakes world of finance and the potential dangers of relying too heavily on mathematical models.

Who should read The Quants?

- Individuals interested in the intersection of finance and technology

- Readers curious about the rise of quantitative trading and its impact on the financial industry

- Those looking to understand the potential risks and rewards of algorithmic trading

What's Equity Markets and Portfolio Analysis about?

Equity Markets and Portfolio Analysis by R. Stafford Johnson provides a comprehensive overview of equity markets and portfolio management. It delves into the principles of stock valuation, investment strategies, and risk management, making it an essential read for finance professionals and students looking to gain a deeper understanding of the complexities of equity markets.

Who should read Equity Markets and Portfolio Analysis?

Investment professionals looking to deepen their understanding of equity markets and portfolio analysis

Finance students seeking a comprehensive and practical guide to investment concepts and strategies

Individuals interested in leveraging the Bloomberg system for investment research and analysis

What's Why Stock Markets Crash about?

Why Stock Markets Crash by Didier Sornette delves into the underlying causes of stock market crashes, challenging the traditional view that they are unpredictable and inexplicable. Sornette presents a new framework based on complex systems theory, behavioral finance, and empirical evidence, offering insights into the dynamics of financial markets and the factors that lead to their collapse. A thought-provoking read for anyone interested in understanding the fragility of the global economy.

Who should read Why Stock Markets Crash?

Investors and traders looking to understand the underlying mechanisms of stock market crashes

Financial professionals seeking to improve their risk management strategies

Researchers and academics interested in the intersection of complex systems and economics

Related Topics

Finance Books

FAQs

What's the best Finance book to read?

What are the Top 10 Finance books?

- Flash Boys by Michael Lewis

- Reminiscences of a Stock Operator by Edwin Lefèvre

- The Business Of The 21st Century by Robert T. Kiyosaki, John Fleming & Kim Kiyosaki

- A Random Walk Down Wall Street by Burton G. Malkiel

- Too Big to Fail by Andrew Ross Sorkin

Who are the top Finance book authors?

- Michael Lewis

- Edwin Lefèvre

- Robert T. Kiyosaki, John Fleming & Kim Kiyosaki

- Burton G. Malkiel

- Andrew Ross Sorkin