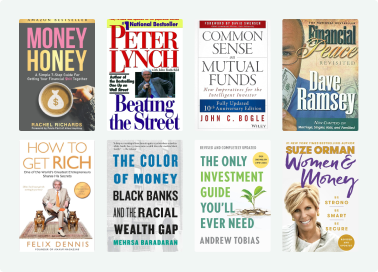

The best 22 Money books

Money makes the world go round, they say. But how well do we really understand it? Financial literacy is a crucial life skill, and this book list is here to help you navigate the world of money. From budgeting and investing to understanding the psychology of money, these books provide a holistic approach to managing your finances. So, whether you're a finance newbie or a seasoned investor, this collection has something for everyone.

What's Flash Boys about?

Flash Boys (2014) is an investigation into the dark underbelly of the US financial markets. It also chronicles the birth of a new stock exchange, the IEX, created to counteract a rigged system that was facilitated by technological loopholes and a lack of transparency.

Who should read Flash Boys?

- Anyone who’s ever invested in the stock market

- People interested in stories of financial corruption

- Fans of underdogs who fight the system

Life After Google

What's Life After Google about?

Life After Google (2018), shows how the future may instead lie in the “cryptocosm” and its blockchain architecture, which allows everyone to exert individual control of data and security online. Since the dawn of the internet, there have been tremendous progress in technology and the way people live their lives. And at the heart of it all is Google, a company that has managed to build a global way of thinking around their business model and vision. But it’s also falling rapidly out of favor with users for its lack of security precautions. Google may once have dominated, but we should prepare for a world that is no longer defined by it.

Who should read Life After Google?

- Business buffs who want to know where the future is headed

- Technology enthusiasts who want to understand the latest developments

- Anyone with an interest in their online data security

The Bitcoin Standard

What's The Bitcoin Standard about?

The Bitcoin Standard (2018) traces the story of money, from the very first rock currencies to the Victorians’ love affair with gold and today’s new kid on the block – digital cryptocurrency. Saifedean Ammous, an economist convinced that we need to embrace the forgotten virtues of sound money, believes Bitcoin might just be the future. Like yesteryear’s gold reserves, it has unique properties that mean it’s ideally placed to act as a medium of exchange that can’t be manipulated by bumbling governments. And that’s great news if we want to return our economies to stability and growth and put the cycle of boom and bust behind us.

Who should read The Bitcoin Standard?

- People interested in the history of money

- Economists and business buffs

- Anyone with an eye on the future

The Promise of Bitcoin

What's The Promise of Bitcoin about?

The Promise of Bitcoin (2021) is an introduction to the financial revolution that began in 2009 – the year an anonymous coder who called himself Satoshi Nakamoto launched Bitcoin. Rooted in the conviction that old monetary systems have failed us, this digital currency promises a more trustworthy, decentralized, and democratic alternative. How does it work? Few people can explain that better than Bobby Lee, a Bitcoin pioneer who’s been on the barricades since the revolution’s earliest days.

Who should read The Promise of Bitcoin?

- Investors looking for new opportunities

- Critics of the banking system

- Technophobes wondering what all the Bitcoin fuss is about

What's Reminiscences of a Stock Operator about?

Reminiscences of a Stock Operator (1923) looks at the life and trading strategies of Jesse Livermore, a professional stock and commodities trader, through the pseudonymous character of Larry Livingston. It explores the psychological challenges and strategic complexities of trading, offering timeless insights into market behavior and the discipline required for success in the financial world.

Who should read Reminiscences of a Stock Operator?

- Aspiring traders seeking market wisdom

- Investors interested in trading history

- Business students applying real-world trading

What's The Business Of The 21st Century about?

The Business Of The 21st Century (2010) focuses on the transformative power of network marketing. It advocates for the creation of personal wealth through entrepreneurship, emphasizing the shift from traditional employment to innovative, individual-driven business models. It provides insights into leveraging networking and direct sales as tools for financial success and personal growth.

Who should read The Business Of The 21st Century?

- Aspiring entrepreneurs interested in network marketing opportunities

- Individuals open to non-traditional income streams

- Employees seeking to control their financial future

A Random Walk Down Wall Street

What's A Random Walk Down Wall Street about?

A Random Walk Down Wall Street (1973) looks at the unpredictability of stock market prices, linking their movements to a “random walk.” It dispels the generally accepted belief in discernible market patterns, suggesting that consistent gains are not a product of easily-chartered trends.

Who should read A Random Walk Down Wall Street?

- Aspiring investors

- Stock market analysts

- Economists interested in financial market patterns

Too Big to Fail

What's Too Big to Fail about?

Too Big to Fail (2009) draws you into the heart of the 2008 financial crisis, revealing the high-stakes decisions and power struggles that shaped the world's economic landscape at that time. This gripping narrative untangles a complex web of financial intrigue, and will help you understand the forces that drove one of the most tumultuous periods in financial history.

Who should read Too Big to Fail?

- Finance professionals interested in economic crisis insights

- History buffs exploring twenty-first-century financial events

- Business students studying real-world corporate strategy

What's The Little Book That Beats the Market about?

In this book, Joel Greenblatt shares a simple yet effective investment strategy that aims to outperform the market. He introduces the concept of "magic formula investing" which focuses on buying good companies at bargain prices. Through clear explanations and real-life examples, Greenblatt provides valuable insights for both novice and experienced investors. Whether you're interested in stock market investing or simply want to understand how to make better financial decisions, this book offers practical advice and a unique perspective.

Who should read The Little Book That Beats the Market?

- Individuals looking for a practical guide to investing in the stock market

- Those who want to learn a simple, yet effective strategy for selecting profitable stocks

- Beginner investors who are interested in learning from a successful investor with a proven track record

DotCom Secrets

What's DotCom Secrets about?

DotCom Secrets is a book that reveals the strategies and techniques for building a successful online business. Written by marketing expert Dan Kennedy, the book provides valuable insights into creating sales funnels, driving traffic, and converting leads into customers. It is a must-read for anyone looking to thrive in the digital marketplace.

Who should read DotCom Secrets?

- Entrepreneurs looking to create successful online businesses

- Individuals interested in learning about online marketing and sales strategies

- People who want to understand the principles behind building a strong online presence and generating leads

What's Beating the Street about?

Beating the Street by Peter Lynch and John Rothchild is a comprehensive guide to successful stock market investing. Drawing from his own experiences as a renowned fund manager, Lynch shares valuable insights and practical advice on how to identify lucrative investment opportunities, analyze financial statements, and navigate the complexities of the market. Whether you're a novice or seasoned investor, this book offers valuable strategies for beating the odds and achieving financial success.

Who should read Beating the Street?

- Individuals who want to learn how to successfully invest in the stock market

- Beginner and intermediate investors looking for practical advice and strategies

- People who are interested in understanding how to analyze and pick stocks

What's Financial Peace Revisited about?

Financial Peace Revisited, by Dave Ramsey and Sharon Ramsey, is a comprehensive guide to achieving financial stability and freedom. It offers practical advice on budgeting, saving, and investing, as well as tips for getting out of debt. Through real-life examples and relatable anecdotes, the book provides a step-by-step plan for taking control of your finances and building a secure future.

Who should read Financial Peace Revisited?

- Individuals who want to take control of their finances and achieve financial freedom

- People who are struggling with debt and want to learn how to get out of it

- Those who are looking for practical and actionable advice on budgeting, saving, and investing

What's The Treasure Principle about?

The Treasure Principle by Randy Alcorn challenges readers to rethink their approach to money and possessions. Drawing on biblical wisdom and real-life examples, Alcorn presents a compelling case for living a generous and contented life. This book will inspire you to prioritize eternal treasures over temporary wealth.

Who should read The Treasure Principle?

- Individuals seeking to cultivate a generous and giving mindset

- People who want to align their financial choices with their values and faith

- Readers interested in understanding the spiritual and eternal significance of their wealth and possessions

What's Common Sense on Mutual Funds about?

Common Sense on Mutual Funds by John C. Bogle provides valuable insights into the world of mutual funds and offers practical advice for investors. Through this book, Bogle challenges the prevailing investment practices and introduces his concept of low-cost index fund investing. It presents a compelling case for passive investing and empowers readers to make informed decisions about their investments.

Who should read Common Sense on Mutual Funds?

- Individuals who want to understand the basics of mutual fund investing

- Beginner and intermediate investors looking for practical advice and insights

- Those who prefer a conservative, long-term approach to wealth building

What's How to Get Rich about?

How to Get Rich by Felix Dennis is a candid and no-nonsense guide to achieving wealth. Drawing from his own experiences as a self-made millionaire, Dennis shares valuable insights and practical advice on building a successful business, taking calculated risks, and embracing the mindset of an entrepreneur. This book challenges conventional wisdom and offers a refreshing perspective on the path to financial success.

Who should read How to Get Rich?

- Individuals who are seeking financial success and wealth

- Entrepreneurs looking for practical advice on building a business

- People who want to challenge conventional wisdom about money and success

What's Alexander, Who Used to Be Rich Last Sunday about?

Alexander, Who Used to Be Rich Last Sunday by Judith Viorst and Ray Cruz tells the story of a young boy who receives a dollar from his grandparents and plans all the things he will buy with it. However, as he spends his money throughout the week, he learns valuable lessons about the value of money and the importance of making wise choices.

Who should read Alexander, Who Used to Be Rich Last Sunday?

- Parents looking to teach their children about the value of money and responsible spending

- Children who enjoy relatable and entertaining stories about everyday challenges

- Educators who want to incorporate financial literacy lessons into their curriculum

What's The Color of Money about?

The Color of Money by Mehrsa Baradaran delves into the history of racial inequality in the United States through the lens of banking and financial systems. It explores how government policies and banking practices have perpetuated wealth disparities between white and black Americans, and offers thought-provoking insights into the ongoing challenges of economic justice.

Who should read The Color of Money?

- Individuals interested in understanding the history and impact of racial wealth disparities

- Entrepreneurs and business owners looking to support and invest in minority-owned businesses

- Policy makers and advocates seeking to address systemic economic inequalities

What's Women & Money about?

Women & Money by Suze Orman offers practical financial advice tailored specifically for women. The book addresses the unique challenges and opportunities women face when it comes to managing their money, providing valuable insights and tips for achieving financial independence and security. Orman advocates for women to take control of their finances and make empowered decisions to secure their future.

Who should read Women & Money?

- Women who want to take control of their financial future

- Those looking to gain a better understanding of money management and investing

- People who want practical advice on building wealth and securing their financial independence

What's The Only Investment Guide You'll Ever Need about?

The Only Investment Guide You'll Ever Need (1978) by Andrew Tobias offers practical advice on how to make smart investment decisions. Written in an engaging and easy-to-understand style, the book covers a wide range of topics including stocks, bonds, real estate, and retirement planning. It aims to empower readers to take control of their finances and build a secure financial future.

Who should read The Only Investment Guide You'll Ever Need?

- Individuals who want to learn how to manage their money effectively

- People who are eager to understand the basics of investing and building wealth

- Readers who prefer a practical and straightforward approach to finance

What's Money Honey about?

Money Honey by Rachel Richards is a personal finance book that offers a fresh and relatable perspective on managing money. Through her own experiences and practical advice, Richards aims to empower readers to take control of their finances and build a secure financial future. Whether you're struggling with debt, saving for the future, or just want to improve your financial literacy, this book provides valuable insights and actionable tips to help you achieve your money goals.

Who should read Money Honey?

- Individuals who want to take control of their personal finances and build wealth

- Young adults who are new to budgeting, saving, and investing

- People who are looking for a lighthearted and easy-to-understand approach to money management

What's Early Retirement Extreme about?

Early Retirement Extreme by Jacob Lund Fisker is a thought-provoking book that challenges the traditional notion of retirement. Fisker presents a radical approach to achieving financial independence and early retirement through frugality, self-sufficiency, and smart investing. Packed with practical advice and real-life examples, this book offers a unique perspective on how we can break free from the conventional 9-5 work life and live on our own terms.

Who should read Early Retirement Extreme?

- Individuals who want to achieve financial independence and retire early

- People interested in minimalist living and reducing their expenses

- Those who are willing to challenge traditional notions of retirement and work

Economics in One Lesson

What's Economics in One Lesson about?

In this classic book, Henry Hazlitt presents a concise and accessible introduction to the principles of economics. Through clear and practical examples, he demonstrates how economic policies and decisions can have both seen and unseen consequences. Hazlitt argues for a free-market approach and challenges common misconceptions about economic issues, making it a must-read for anyone interested in understanding the fundamentals of economics.

Who should read Economics in One Lesson?

- Individuals seeking a clear and concise understanding of economics

- Readers interested in learning about the unintended consequences of government intervention in the economy

- Those who want to become more informed citizens and make better economic decisions

Related Topics

Money Books

FAQs

What's the best Money book to read?

What are the Top 10 Money books?

- Flash Boys by Michael Lewis

- Life After Google by George Gilder

- The Bitcoin Standard by Saifedean Ammous

- The Promise of Bitcoin by Bobby C. Lee

- Reminiscences of a Stock Operator by Edwin Lefèvre

- The Business Of The 21st Century by Robert T. Kiyosaki, John Fleming & Kim Kiyosaki

- A Random Walk Down Wall Street by Burton G. Malkiel

- Too Big to Fail by Andrew Ross Sorkin

Who are the top Money book authors?

- Michael Lewis

- George Gilder

- Saifedean Ammous

- Bobby C. Lee

- Edwin Lefèvre