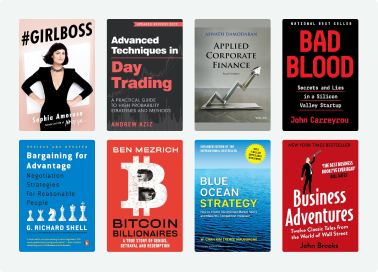

The best 22 Corporate Finance books

Corporate finance is a complex and vital aspect of the business world. To help you navigate this intricate field, we've curated a comprehensive book list. From financial management to valuation techniques, these titles cover all critical elements of corporate finance.

Whether you're a finance professional, a business owner, or simply interested in understanding the financial side of companies, this collection will provide you with valuable insights and practical knowledge.

Corporate Finance for Dummies

What's Corporate Finance for Dummies about?

Corporate Finance for Dummies by Michael Taillard is a comprehensive guide that simplifies complex financial concepts for beginners. It covers topics such as financial statements, valuation, capital budgeting, and risk management, making it an essential read for anyone looking to understand the world of corporate finance.

Who should read Corporate Finance for Dummies?

- Individuals interested in learning about corporate finance

- Business students looking for a beginner-friendly guide to finance concepts

- Professionals seeking to expand their knowledge of financial management and decision-making

Finance for Nonfinancial Managers

What's Finance for Nonfinancial Managers about?

Finance for Nonfinancial Managers by Gene Siciliano provides a comprehensive guide to understanding and managing financial aspects of a business. It covers essential topics such as financial statements, budgeting, cash flow management, and financial analysis in a clear and accessible manner. Whether you're a manager or an entrepreneur, this book will help you make informed financial decisions and contribute to the success of your organization.

Who should read Finance for Nonfinancial Managers?

- Managers from non-financial backgrounds who need to understand and interpret financial information

- Entrepreneurs and small business owners looking to manage their finances more effectively

- Professionals transitioning to a managerial role that requires financial oversight

Bitcoin Billionaires

What's Bitcoin Billionaires about?

Bitcoin Billionaires (2019) tells the captivating story of the Winklevoss twins, who went from being known for their legal battle with Mark Zuckerberg over Facebook to becoming early investors in Bitcoin. Written by bestselling author Ben Mezrich, this book chronicles their journey into the world of cryptocurrency and the remarkable rise of Bitcoin.

Who should read Bitcoin Billionaires?

- Readers who are curious about the rise of Bitcoin and cryptocurrency

- Investors looking to understand the potential of digital currency

- Those interested in the entrepreneurial journey of Tyler and Cameron Winklevoss

Technical Analysis of the Financial Markets

What's Technical Analysis of the Financial Markets about?

📚 "Technical Analysis of the Financial Markets" by John J. Murphy provides a comprehensive guide to understanding and applying technical analysis in the stock, bond, and commodity markets. It covers a wide range of technical tools and indicators, as well as how to interpret price patterns and trends. Whether you're a novice or an experienced trader, this book offers valuable insights to enhance your market analysis skills.

Who should read Technical Analysis of the Financial Markets?

- Individuals interested in understanding and predicting market movements

- Traders seeking to improve their technical analysis skills

- Investors looking to make more informed decisions based on market trends

Dear Chairman

What's Dear Chairman about?

Dear Chairman by Jeff Gramm explores the fascinating world of activist investors and their impact on corporate governance. Through in-depth case studies and insightful analysis, the book reveals the power struggles and shareholder activism that have shaped the business world. It offers valuable lessons for investors and corporate leaders alike, making it a must-read for anyone interested in understanding the dynamics of the stock market.

Who should read Dear Chairman?

- Individuals interested in the inner workings of corporate governance

- Investors looking to understand the dynamics between shareholders and company management

- Business professionals seeking insights into the power struggles within public companies

Options as a Strategic Investment

What's Options as a Strategic Investment about?

Options as a Strategic Investment by Lawrence G. McMillan is a comprehensive guide to understanding and utilizing options as a strategic investment tool. It covers everything from basic concepts to advanced strategies, making it a valuable resource for both novice and experienced options traders. With clear explanations and real-world examples, this book provides a solid foundation for anyone looking to incorporate options into their investment approach.

Who should read Options as a Strategic Investment?

- Anyone looking to understand options as a form of investment

- Traders and investors seeking to diversify their portfolio with options

- Individuals interested in learning advanced options strategies and techniques

Creating Shareholder Value

What's Creating Shareholder Value about?

Creating Shareholder Value by Alfred Rappaport explores the importance of aligning corporate strategy with the goal of maximizing shareholder value. Rappaport argues that companies should focus on generating superior long-term cash flows and making strategic investment decisions that benefit shareholders. The book offers practical insights and tools for managers, investors, and analysts to evaluate and improve a company's performance in creating value for its owners.

Who should read Creating Shareholder Value?

- Focused on corporate finance and value creation

- Designed for business professionals, investors, and finance students

- Interested in understanding the impact of strategic decisions on shareholder wealth

What It Takes

What's What It Takes about?

What It Takes by Stephen A. Schwarzman offers a behind-the-scenes look at the world of finance and business. Through personal anecdotes and valuable insights, Schwarzman shares the principles and strategies that have guided his remarkable career. This book is a must-read for anyone interested in understanding the mindset and determination required to achieve extraordinary success.

Who should read What It Takes?

- Individuals interested in learning from the experiences of a successful business leader

- Entrepreneurs seeking insights into building and growing a thriving organization

- Professionals looking to elevate their leadership and decision-making skills

Damodaran on Valuation

What's Damodaran on Valuation about?

Damodaran on Valuation by Aswath Damodaran is a comprehensive guide to understanding the intricacies of valuation in the world of finance. With real-world examples and practical insights, the book delves into various valuation techniques and provides a framework for analyzing and valuing different types of assets. Whether you're a student, investor, or finance professional, this book offers valuable knowledge that can help you make informed decisions in the world of investments.

Who should read Damodaran on Valuation?

- Finance professionals seeking a comprehensive understanding of valuation techniques

- Students pursuing a career in investment banking, corporate finance, or financial analysis

- Investors looking to sharpen their valuation skills and make more informed investment decisions

Understanding Stocks

What's Understanding Stocks about?

Understanding Stocks by Michael Sincere is a comprehensive guide for beginners looking to enter the world of stock market investing. The book covers essential topics such as how stocks are traded, different investment strategies, and risk management. Sincere provides valuable insights and practical advice to help readers navigate the complexities of the stock market with confidence.

Who should read Understanding Stocks?

- People who want to learn about investing in stocks

- Beginner investors looking for a comprehensive guide to the stock market

- Individuals who want to understand how to analyze and pick stocks

Incerto

What's Incerto about?

Incerto is a thought-provoking book series by Nassim Nicholas Taleb that challenges our understanding of randomness, uncertainty, and risk. Through books like The Black Swan and Antifragile, Taleb explores how unpredictable events shape our world and offers insights on how to navigate and thrive in an uncertain future.

Who should read Incerto?

- Individuals interested in understanding and navigating uncertainty

- Readers who enjoy thought-provoking and intellectually challenging books

- Professionals looking to improve decision-making skills and risk management

That Will Never Work

What's That Will Never Work about?

That Will Never Work by Marc Randolph is an inspiring memoir that chronicles the early days of Netflix and the challenges faced by its co-founder. With honesty and humor, Randolph shares the ups and downs of building a revolutionary business in the face of skepticism and doubt. It's a must-read for anyone with big ambitions and a belief in their own crazy ideas.

Who should read That Will Never Work?

- Entrepreneurs and aspiring business owners looking for inspiration and practical advice

- Individuals interested in the behind-the-scenes story of a successful startup

- Readers who enjoy personal memoirs that blend storytelling with valuable lessons

The Only Investment Guide You'll Ever Need

What's The Only Investment Guide You'll Ever Need about?

The Only Investment Guide You'll Ever Need (1978) by Andrew Tobias offers practical advice on how to make smart investment decisions. Written in an engaging and easy-to-understand style, the book covers a wide range of topics including stocks, bonds, real estate, and retirement planning. It aims to empower readers to take control of their finances and build a secure financial future.

Who should read The Only Investment Guide You'll Ever Need?

- Individuals who want to learn how to manage their money effectively

- People who are eager to understand the basics of investing and building wealth

- Readers who prefer a practical and straightforward approach to finance

How To Swing Trade

What's How To Swing Trade about?

How to Swing Trade by Andrew Aziz and Brian Pezim is a comprehensive guide for anyone looking to learn the art of swing trading. The book covers everything from the basics of swing trading to advanced strategies, risk management, and practical tips for success. Whether you're a beginner or an experienced trader, this book provides valuable insights and actionable advice to help you become a successful swing trader.

Who should read How To Swing Trade?

- Traders and investors looking to learn swing trading strategies

- Individuals who want to improve their stock trading skills and profitability

- Those interested in understanding technical analysis and chart patterns

Advanced Techniques in Day Trading

What's Advanced Techniques in Day Trading about?

Advanced Techniques in Day Trading by Andrew Aziz delves into the more intricate aspects of day trading, offering in-depth strategies and analysis. From advanced charting techniques to risk management and psychological pitfalls, this book provides a comprehensive guide for experienced traders looking to take their skills to the next level.

Who should read Advanced Techniques in Day Trading?

- Anyone looking to take their day trading skills to the next level

- Experienced day traders who want to refine and optimize their strategies

- Individuals who are committed to mastering technical analysis and chart patterns

Cost of Capital

What's Cost of Capital about?

Cost of Capital by Shannon P. Pratt and Roger J. Grabowski is a comprehensive guide that delves into the intricacies of determining the cost of capital for a business. It provides valuable insights and practical techniques for calculating the cost of equity, debt, and overall capital, and explores its significance in making informed financial decisions. Whether you're a finance professional or a business owner, this book is an essential resource for understanding and applying the concept of cost of capital.

Who should read Cost of Capital?

- Financial analysts seeking a comprehensive understanding of cost of capital

- Business owners and executives aiming to make informed investment and financial decisions

- Students and educators studying finance, valuation, and corporate finance

Business Brilliant

What's Business Brilliant about?

Business Brilliant by Lewis Schiff challenges conventional wisdom about what it takes to be successful in business. Through extensive research and interviews with self-made millionaires and entrepreneurs, Schiff uncovers the counterintuitive habits and strategies that set them apart. This book offers valuable insights and practical advice for anyone looking to achieve greater success in their professional endeavors.

Who should read Business Brilliant?

- Entrepreneurs seeking practical advice and insights on wealth-building strategies

- Business professionals looking to enhance their financial acumen and strategic thinking

- Individuals who want to understand the mindset and behaviors of successful business leaders

Starting a Business QuickStart Guide

What's Starting a Business QuickStart Guide about?

Starting a Business QuickStart Guide by Ken Colwell PhD MBA is a comprehensive and practical book that provides step-by-step guidance for aspiring entrepreneurs. It covers everything from developing a business idea to creating a business plan, securing funding, and launching the business. With real-life examples and actionable tips, this book is a valuable resource for anyone looking to start their own business.

Who should read Starting a Business QuickStart Guide?

- Entrepreneurs who are looking to start their own business

- Individuals who want to turn their passion into a successful business

- Small business owners who need guidance on growing and scaling their ventures

Applied Corporate Finance

What's Applied Corporate Finance about?

Applied Corporate Finance by Aswath Damodaran provides a practical and comprehensive guide to understanding the principles of corporate finance and applying them to real-world business decisions. Through case studies and examples, the book covers topics such as valuation, capital budgeting, and risk management, making it an essential resource for students and professionals in the field.

Who should read Applied Corporate Finance?

- Business students and professionals seeking a practical understanding of corporate finance

- Those looking to learn how to apply financial theories to real-world business scenarios

- Readers interested in valuation, capital budgeting, and risk management within corporations

Super Pumped

What's Super Pumped about?

Super Pumped by Mike Isaac is a gripping account of the rise and fall of Uber, one of the most influential and controversial companies of our time. Through meticulous research and interviews, Isaac delves into the ruthless tactics, cutthroat competition, and larger-than-life personalities that shaped the company. It offers a fascinating insight into the world of tech startups and the disruptive power they wield.

Who should read Super Pumped?

- Entrepreneurs and business leaders eager to understand the rise and fall of Uber

- Readers interested in the dark side of Silicon Valley startup culture

- Individuals curious about the impact of technology on society and the economy

The Theory of Corporate Finance

What's The Theory of Corporate Finance about?

The Theory of Corporate Finance by Jean Tirole provides a comprehensive analysis of the principles and practices of corporate finance. It delves into topics such as capital structure, risk management, and corporate governance, offering valuable insights for students, professionals, and anyone interested in understanding the financial decisions made by companies.

Who should read The Theory of Corporate Finance?

- Graduate students or professors studying corporate finance

- Professionals working in finance or investment banking

- Entrepreneurs and business owners looking to understand financial decision-making

La escuela de negocios

What's La escuela de negocios about?

La escuela de negocios es un libro escrito por Robert T. Kiyosaki que ofrece una perspectiva diferente sobre la educación financiera y la forma en que se enseña en las escuelas tradicionales. Kiyosaki comparte sus propias experiencias y reflexiones para ayudar a los lectores a comprender cómo pueden adquirir las habilidades necesarias para tener éxito en el mundo de los negocios. A través de anécdotas y consejos prácticos, el autor desafía las creencias convencionales y ofrece un enfoque alternativo para alcanzar la libertad financiera.

Who should read La escuela de negocios?

Personas interesadas en emprender en el ámbito de los negocios

Profesionales que deseen mejorar sus habilidades financieras

Individuos que busquen una perspectiva diferente sobre la educación y el éxito en el mundo empresarial

Related Topics

Corporate Finance Books

FAQs

What's the best Corporate Finance book to read?

What are the Top 10 Corporate Finance books?

- Corporate Finance for Dummies by Michael Taillard

- Finance for Nonfinancial Managers by Gene Siciliano

- Bitcoin Billionaires by Ben Mezrich

- Technical Analysis of the Financial Markets by John J. Murphy

- Dear Chairman by Jeff Gramm

- Options as a Strategic Investment by Lawrence G. McMillan

- Creating Shareholder Value by Alfred Rappaport

- What It Takes by Stephen A. Schwarzman

- Damodaran on Valuation by Aswath Damodaran

- Understanding Stocks by Michael Sincere

Who are the top Corporate Finance book authors?

- Michael Taillard

- Gene Siciliano

- Ben Mezrich

- John J. Murphy

- Jeff Gramm