The best 31 Money Management books

Managing money is a necessary skill for everyone, but it can often feel overwhelming. That's why we've put together this book list on money management. From creating a budget to investing wisely, these books will give you the knowledge and strategies you need to take control of your finances. Whether you're just starting out or looking to improve your financial savvy, this collection has something for you. So dive in and start building a solid foundation for your financial future.

Life After Google

What's Life After Google about?

Life After Google (2018), shows how the future may instead lie in the “cryptocosm” and its blockchain architecture, which allows everyone to exert individual control of data and security online. Since the dawn of the internet, there have been tremendous progress in technology and the way people live their lives. And at the heart of it all is Google, a company that has managed to build a global way of thinking around their business model and vision. But it’s also falling rapidly out of favor with users for its lack of security precautions. Google may once have dominated, but we should prepare for a world that is no longer defined by it.

Who should read Life After Google?

- Business buffs who want to know where the future is headed

- Technology enthusiasts who want to understand the latest developments

- Anyone with an interest in their online data security

The Bitcoin Standard

What's The Bitcoin Standard about?

The Bitcoin Standard (2018) traces the story of money, from the very first rock currencies to the Victorians’ love affair with gold and today’s new kid on the block – digital cryptocurrency. Saifedean Ammous, an economist convinced that we need to embrace the forgotten virtues of sound money, believes Bitcoin might just be the future. Like yesteryear’s gold reserves, it has unique properties that mean it’s ideally placed to act as a medium of exchange that can’t be manipulated by bumbling governments. And that’s great news if we want to return our economies to stability and growth and put the cycle of boom and bust behind us.

Who should read The Bitcoin Standard?

- People interested in the history of money

- Economists and business buffs

- Anyone with an eye on the future

The Promise of Bitcoin

What's The Promise of Bitcoin about?

The Promise of Bitcoin (2021) is an introduction to the financial revolution that began in 2009 – the year an anonymous coder who called himself Satoshi Nakamoto launched Bitcoin. Rooted in the conviction that old monetary systems have failed us, this digital currency promises a more trustworthy, decentralized, and democratic alternative. How does it work? Few people can explain that better than Bobby Lee, a Bitcoin pioneer who’s been on the barricades since the revolution’s earliest days.

Who should read The Promise of Bitcoin?

- Investors looking for new opportunities

- Critics of the banking system

- Technophobes wondering what all the Bitcoin fuss is about

A Random Walk Down Wall Street

What's A Random Walk Down Wall Street about?

A Random Walk Down Wall Street (1973) looks at the unpredictability of stock market prices, linking their movements to a “random walk.” It dispels the generally accepted belief in discernible market patterns, suggesting that consistent gains are not a product of easily-chartered trends.

Who should read A Random Walk Down Wall Street?

- Aspiring investors

- Stock market analysts

- Economists interested in financial market patterns

Rich Dad's Increase Your Financial IQ

What's Rich Dad's Increase Your Financial IQ about?

Increase Your Financial IQ (2011) is a guide to building financial intelligence and taking control of your financial future. It lays out key principles for protecting your money, budgeting, leveraging your assets, and continuously improving your financial knowledge.

Who should read Rich Dad's Increase Your Financial IQ?

- Individuals and families striving to build long-term wealth

- Small investors seeking to make smarter, more informed decisions

- Anyone feeling overwhelmed or confused by personal finance

The No-Spend Challenge Guide

What's The No-Spend Challenge Guide about?

The No-Spend Challenge Guide by Jen Smith is a practical and inspiring book that offers a step-by-step plan to help you take control of your finances. By embarking on a series of no-spend challenges, you'll learn how to break free from the cycle of mindless spending and start saving money. With helpful tips and real-life examples, this book will empower you to achieve your financial goals and live a more intentional life.

Who should read The No-Spend Challenge Guide?

- Individuals who want to improve their financial habits and reduce their spending

- People looking to pay off debt and save more money

- Readers who are open to trying a no-spend challenge to change their money mindset

Rich Bitch

What's Rich Bitch about?

'Rich Bitch' by Nicole Lapin is a bold and empowering guide to taking control of your finances. With a no-nonsense approach, Lapin breaks down complex money concepts and provides practical tips for women to build wealth and financial independence. Whether you're a financial newbie or ready to level up your money game, this book is the kick in the pants you need to become a true 'rich bitch'>.

Who should read Rich Bitch?

- Anyone who wants to take control of their finances and build wealth

- People who are looking for practical and actionable advice on money management

- Readers who enjoy a candid and entertaining writing style

What's How to Manage Your Money When You Don't Have Any about?

How to Manage Your Money When You Don't Have Any by Erik Wecks is a practical guide for individuals facing financial challenges. It offers realistic advice and actionable steps for budgeting, saving, and making the most of limited resources. With a focus on changing mindset and habits, this book empowers readers to take control of their finances and work towards a more secure future.

Who should read How to Manage Your Money When You Don't Have Any?

- Individuals who are living paycheck to paycheck

- Recent graduates and young professionals trying to navigate their finances

- People who want practical and relatable advice on managing their money

University of Berkshire Hathaway

What's University of Berkshire Hathaway about?

University of Berkshire Hathaway by Daniel Pecaut and Corey Wrenn offers a unique insight into the annual shareholder meetings of Warren Buffett's Berkshire Hathaway. Through a collection of essays and interviews, the book delves into the investment philosophy and business principles that have made Berkshire Hathaway one of the most successful companies in the world. It provides valuable lessons for investors and business enthusiasts alike.

Who should read University of Berkshire Hathaway?

- Individuals interested in learning from the investment strategies of Warren Buffett and Charlie Munger

- Business professionals seeking insights into long-term value investing

- Aspiring entrepreneurs looking to understand the principles of successful business management

Women & Money

What's Women & Money about?

Women & Money by Suze Orman offers practical financial advice tailored specifically for women. The book addresses the unique challenges and opportunities women face when it comes to managing their money, providing valuable insights and tips for achieving financial independence and security. Orman advocates for women to take control of their finances and make empowered decisions to secure their future.

Who should read Women & Money?

- Women who want to take control of their financial future

- Those looking to gain a better understanding of money management and investing

- People who want practical advice on building wealth and securing their financial independence

The Ultimate Scholarship Book 2020

What's The Ultimate Scholarship Book 2020 about?

The Ultimate Scholarship Book 2020 by Gen Tanabe is a comprehensive guide to finding and winning scholarships. It provides valuable tips and advice on how to search for scholarships, write compelling essays, and submit strong applications. With detailed information on thousands of scholarships, this book is a must-have for students looking to fund their education.

Who should read The Ultimate Scholarship Book 2020?

- High school students seeking scholarships for college

- College students looking for financial aid

- Parents and guardians helping their children fund their education

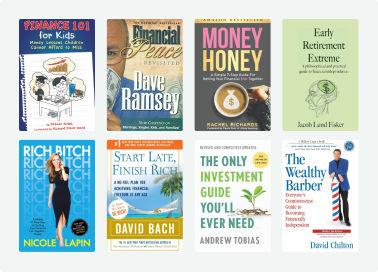

Finance 101 for Kids

What's Finance 101 for Kids about?

Finance 101 for Kids provides a fun and easy-to-understand introduction to the world of money. Through colorful illustrations and engaging explanations, Walter Andal teaches children essential financial concepts such as earning, saving, and spending. This book empowers kids to make smart decisions with their money from an early age.

Who should read Finance 101 for Kids?

- Parents and guardians who want to teach their kids about financial literacy

- Educators looking for resources to supplement financial literacy curriculum

- Kids who are curious about money and want to learn how to manage it wisely

The Financial Peace Planner

What's The Financial Peace Planner about?

The Financial Peace Planner by Dave Ramsey is a comprehensive guide to managing your finances and achieving financial freedom. With practical advice and step-by-step plans, Ramsey helps readers create a budget, get out of debt, and build wealth for the future. This book is a valuable resource for anyone looking to take control of their money and secure their financial well-being.

Who should read The Financial Peace Planner?

- Individuals who want to take control of their finances and get out of debt

- People who are looking to create a personal budget and stick to it

- Readers interested in practical money management tips and strategies

Start Late, Finish Rich

What's Start Late, Finish Rich about?

Start Late, Finish Rich by David Bach offers practical advice for those who may feel behind in their financial goals. The book provides strategies for saving, investing, and building wealth later in life, showing that it's never too late to take control of your financial future.

Who should read Start Late, Finish Rich?

- Individuals who want to take control of their finances and achieve financial security

- People who are starting to plan for retirement later in life

- Those who want practical and actionable advice on money management

Early Retirement Extreme

What's Early Retirement Extreme about?

Early Retirement Extreme by Jacob Lund Fisker is a thought-provoking book that challenges the traditional notion of retirement. Fisker presents a radical approach to achieving financial independence and early retirement through frugality, self-sufficiency, and smart investing. Packed with practical advice and real-life examples, this book offers a unique perspective on how we can break free from the conventional 9-5 work life and live on our own terms.

Who should read Early Retirement Extreme?

- Individuals who want to achieve financial independence and retire early

- People interested in minimalist living and reducing their expenses

- Those who are willing to challenge traditional notions of retirement and work

Money Honey

What's Money Honey about?

Money Honey by Rachel Richards is a personal finance book that offers a fresh and relatable perspective on managing money. Through her own experiences and practical advice, Richards aims to empower readers to take control of their finances and build a secure financial future. Whether you're struggling with debt, saving for the future, or just want to improve your financial literacy, this book provides valuable insights and actionable tips to help you achieve your money goals.

Who should read Money Honey?

- Individuals who want to take control of their personal finances and build wealth

- Young adults who are new to budgeting, saving, and investing

- People who are looking for a lighthearted and easy-to-understand approach to money management

The Ultimate Retirement Guide for 50+

What's The Ultimate Retirement Guide for 50+ about?

The Ultimate Retirement Guide for 50+ by Suze Orman provides comprehensive advice and strategies for planning a secure and fulfilling retirement. From managing your finances and investments to making the most of your retirement savings, this book offers practical tips and insights to help you navigate this important life transition with confidence.

Who should read The Ultimate Retirement Guide for 50+?

- Individuals aged 50 and above who are planning for retirement

- Those who want to maximize their retirement savings and income

- People who are looking for comprehensive financial advice tailored to their life stage

The Only Investment Guide You'll Ever Need

What's The Only Investment Guide You'll Ever Need about?

The Only Investment Guide You'll Ever Need (1978) by Andrew Tobias offers practical advice on how to make smart investment decisions. Written in an engaging and easy-to-understand style, the book covers a wide range of topics including stocks, bonds, real estate, and retirement planning. It aims to empower readers to take control of their finances and build a secure financial future.

Who should read The Only Investment Guide You'll Ever Need?

- Individuals who want to learn how to manage their money effectively

- People who are eager to understand the basics of investing and building wealth

- Readers who prefer a practical and straightforward approach to finance

Passive Income Freedom: 23 Passive Income Blueprints

What's Passive Income Freedom: 23 Passive Income Blueprints about?

Passive Income Freedom: 23 Passive Income Blueprints by Gundi Gabrielle provides a comprehensive guide to creating multiple streams of passive income. From affiliate marketing to creating digital products, this book offers practical strategies and step-by-step blueprints to help you achieve financial freedom and live life on your own terms.

Who should read Passive Income Freedom: 23 Passive Income Blueprints?

- Budding entrepreneurs looking for passive income ideas

- People who want to achieve financial independence and free up their time

- Individuals seeking to diversify their income streams and create long-term wealth

The Wealthy Barber

What's The Wealthy Barber about?

The Wealthy Barber by David Chilton is a personal finance book that offers practical advice on how to build wealth and secure your financial future. Through a fictional story about a barber who shares his financial wisdom with his clients, Chilton presents key principles such as saving, investing, and planning for retirement in an easy-to-understand and relatable way.

Who should read The Wealthy Barber?

- Individuals who want to improve their financial literacy

- People who are looking for practical advice on saving and investing

- Anyone interested in building long-term wealth and financial security

Financial Peace Revisited

What's Financial Peace Revisited about?

Financial Peace Revisited, by Dave Ramsey and Sharon Ramsey, is a comprehensive guide to achieving financial stability and freedom. It offers practical advice on budgeting, saving, and investing, as well as tips for getting out of debt. Through real-life examples and relatable anecdotes, the book provides a step-by-step plan for taking control of your finances and building a secure future.

Who should read Financial Peace Revisited?

- Individuals who want to take control of their finances and achieve financial freedom

- People who are struggling with debt and want to learn how to get out of it

- Those who are looking for practical and actionable advice on budgeting, saving, and investing

The 9 Steps to Financial Freedom

What's The 9 Steps to Financial Freedom about?

The 9 Steps to Financial Freedom by Suze Orman provides a comprehensive guide to taking control of your finances and achieving long-term security. Orman outlines nine practical steps that cover everything from creating a realistic budget to investing wisely and planning for retirement. With real-life examples and actionable advice, this book empowers readers to make positive changes and build a solid financial foundation.

Who should read The 9 Steps to Financial Freedom?

- Individuals looking to gain control over their finances and build wealth

- People who want to create a solid financial plan for their future

- Those who seek practical and actionable steps to improve their financial situation

Why Didn't They Teach Me This in School?

What's Why Didn't They Teach Me This in School? about?

Why Didn't They Teach Me This in School? by Cary Siegel is a practical guide to personal finance that covers essential money management skills that are often overlooked in traditional education. From budgeting and saving to investing and building credit, this book offers valuable advice for readers of all ages who want to take control of their financial future.

Who should read Why Didn't They Teach Me This in School??

- Anyone looking to improve their personal finance knowledge

- Youth or young adults who want to learn important money management skills

- Individuals who want practical advice on budgeting, saving, and investing

How to Stop Living Paycheck to Paycheck

What's How to Stop Living Paycheck to Paycheck about?

How to Stop Living Paycheck to Paycheck by Avery Breyer offers practical and actionable tips on breaking free from the cycle of financial struggle. The book provides step-by-step strategies for budgeting, saving, and investing, empowering readers to take control of their finances and build a more secure future.

Who should read How to Stop Living Paycheck to Paycheck?

- Individuals who struggle with managing their finances and living paycheck to paycheck

- People who want to break free from the cycle of debt and build a secure financial future

- Those who are looking for practical and actionable tips to improve their money management skills

Awaken the Giant Within

What's Awaken the Giant Within about?

Awaken the Giant Within is a self-help book by Anthony Robbins that aims to help readers take control of their lives and achieve their dreams. Robbins offers practical advice and strategies for personal development, including ways to change your mindset, set and achieve goals, and create lasting change in your life. Through empowering stories and exercises, the book encourages readers to tap into their inner power and live life to the fullest.

Who should read Awaken the Giant Within?

Individuals seeking personal development and self-improvement

People looking to take control of their lives and achieve their goals

Those who want to understand and change their thought patterns and behaviors

The Latte Factor

What's The Latte Factor about?

The Latte Factor is a personal finance book that challenges the traditional notion that you need to earn a high income to achieve financial freedom. Through a fictional story, the book illustrates how making small, daily changes to your spending and saving habits can lead to big financial results over time. It offers practical advice and tools to help readers take control of their finances and start building wealth, no matter their income level.

Who should read The Latte Factor?

Individuals who want to gain control of their finances and build wealth

People who enjoy learning through relatable stories and practical advice

Readers who are open to changing their spending habits and prioritizing their long-term financial goals

Twenties in Your Pocket

What's Twenties in Your Pocket about?

Twenties in Your Pocket by Kate Nixon Anania is a practical guide to managing your finances in your twenties. It offers valuable advice on budgeting, saving, investing, and navigating the financial challenges that often come with early adulthood. With real-life examples and easy-to-follow tips, this book empowers young adults to take control of their money and build a secure financial future.

Who should read Twenties in Your Pocket?

- Young adults in their 20s who want to gain financial literacy and make smart money decisions

- Individuals who are looking for practical advice on budgeting, saving, and investing

- People who want to avoid common financial pitfalls and build a strong foundation for their future

Buffettology

What's Buffettology about?

Buffettology by Mary Buffett and David Clark provides an in-depth analysis of Warren Buffett's investment strategies. It offers insights into how the legendary investor evaluates companies and makes investment decisions. Through real-life examples and practical advice, the book aims to help readers apply Buffett's principles to their own investment endeavors.

Who should read Buffettology?

Individuals who want to learn about Warren Buffett's investment philosophy and strategies

People who are interested in long-term value investing and building wealth over time

Readers who are looking for practical advice on analyzing financial statements and identifying strong companies

Rich Bitch

What's Rich Bitch about?

Rich Bitch by Nicole Lapin is a witty and practical guide to financial success for women. With a no-nonsense approach, the book breaks down complex money concepts and provides actionable advice on budgeting, saving, investing, and building wealth. Lapin empowers women to take control of their finances and live a life of financial independence.

Who should read Rich Bitch?

Women who want to take control of their finances and build wealth

Those who are looking for practical and relatable money management advice

Readers who enjoy a humorous and straightforward approach to personal finance

Start Late, Finish Rich

What's Start Late, Finish Rich about?

Start Late, Finish Rich by David Bach is a personal finance book that challenges the belief that it's too late to achieve financial success. Bach provides practical advice and strategies for people who are starting to save and invest later in life. Through real-life examples and easy-to-follow steps, the book empowers readers to take control of their finances and create a secure future.

Who should read Start Late, Finish Rich?

Individuals who are approaching retirement age and want to improve their financial situation

People who have struggled with saving and investing in the past and are looking for practical advice

Those who want to create a clear roadmap for building wealth and achieving financial security

The 9 Steps to Financial Freedom

What's The 9 Steps to Financial Freedom about?

The 9 Steps to Financial Freedom by Suze Orman is a comprehensive guide that offers practical advice and strategies for achieving financial stability and independence. Through nine essential steps, Orman addresses common financial challenges and empowers readers to take control of their money, build wealth, and ultimately live a life of financial freedom. With real-life examples and actionable tips, this book is a valuable resource for anyone looking to improve their financial situation.

Who should read The 9 Steps to Financial Freedom?

Individuals who want to take control of their finances and achieve financial independence

People who are looking for practical and actionable steps to improve their financial situation

Those who want to understand the psychological and emotional aspects of money and how it impacts their financial decisions

Related Topics

Money Management Books

FAQs

What's the best Money Management book to read?

What are the Top 10 Money Management books?

- Life After Google by George Gilder

- The Bitcoin Standard by Saifedean Ammous

- The Promise of Bitcoin by Bobby C. Lee

- A Random Walk Down Wall Street by Burton G. Malkiel

- Rich Dad's Increase Your Financial IQ by Robert T. Kiyosaki

- The No-Spend Challenge Guide by Jen Smith

- Rich Bitch by Nicole Lapin

- How to Manage Your Money When You Don't Have Any by Erik Wecks

- University of Berkshire Hathaway by Daniel Pecaut, Corey Wrenn

- Women & Money by Suze Orman

Who are the top Money Management book authors?

- George Gilder

- Saifedean Ammous

- Bobby C. Lee

- Burton G. Malkiel

- Robert T. Kiyosaki